eWEEK content and product recommendations are editorially independent. We may make money when you click on links to our partners. Learn More.

1Apple Pay, Android Pay Poised to Fight for Mobile Wallet Supremacy

2Their Success Depends on Mobile Platform Support

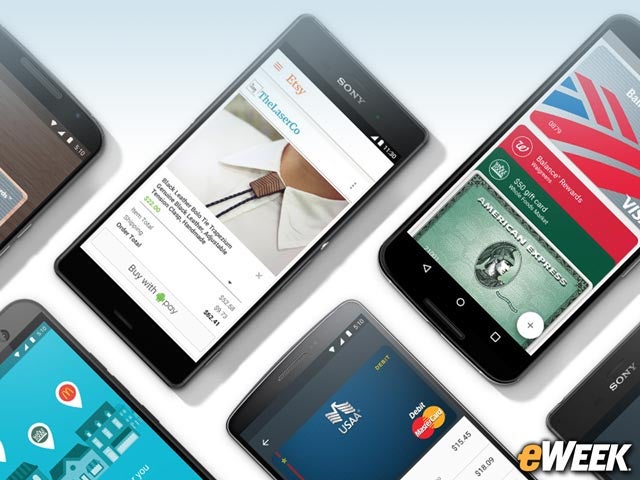

Success or failure in the mobile payments business may ultimately depend on a company’s ability to get its service running on the largest number of devices. For now, Apple Pay is available on Apple’s latest iPhones and Apple Watch. It also supports in-app payments on its iPad. Android Pay, meanwhile, will be available on far more devices when initially released. But as more devices ship with near-field communication (NFC) chips, the number of supported products on either side will only rise. That could be good news for Apple Pay and Android Pay.

3Mobile Payments Will Work With Online Apps, Store Sales Terminals

There is no winner when it comes to the ways in which people can handle payments in Apple Pay or Android Pay. Both applications come with support for both in-store and in-app payments. This means that app developers and brick-and-mortar stores will be able to work with mobile payments. Image 2: Please use this image:

4Apple Relies on the Touch ID

A core component in Apple Pay is Touch ID, the fingerprint sensor built into the company’s latest iPhone models. After choosing a card to handle transactions, Apple’s platform asks users to place their finger over the Touch ID sensor to verify the user’s identity. Over time, more Android devices will support fingerprint sensors. Currently, however, nearly all industry experts agree that Touch ID is superior to fingerprint sensors in Android devices.

5Credit Card Information Isn’t Shared

Whether it’s Android Pay or Apple Pay that a user chooses, it’s worth noting that neither platform actually shares credit card information with the merchant. Instead, they provide a unique payment identification number that sends the payment to the store. This keeps a person’s credit card information out of potentially unsafe hands and potentially limits a person’s chances of having his or her credit card number stolen.

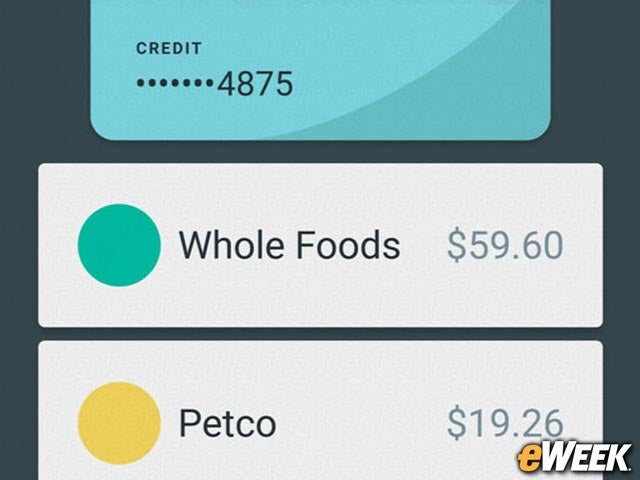

6Tracking Activity Is at Your Fingertips

It’s extremely easy on both Apple Pay and Android Pay to see recent transactions, reducing chances of payment card fraud. Both applications show users all of their recent transactions so they can confirm they are all legitimate. It’s a key feature that’s often overlooked but critical in helping to reduce the amount of payment fraud.

7Both Support Credit, Debit Cards

Both Android Pay and Apple Pay support major credit and debit cards, putting them ahead of CurrentC, another mobile payment service developed by major retailers that will initially support store cards at launch. Lack of support for most major credit and debit cards is a disadvantage for any new mobile payment service. But that won’t be an issue for Android Pay and Apple Pay.

8Apple Pay Has an Initial Edge in Major Bank Support

For now, Apple Pay is winning the battle when it comes to banking support. The service has the backing of most major nationwide banks, including Bank of America, Chase and Wells Fargo. Android Pay currently has a handful of major banks supporting its service, and Google says more support will come as time goes on. Given how big Android is, the company is probably right in believing that Android Pay will add several more banks in the coming months.

9Apple Watch Owners Are Welcome

Apple has added support for Apple Pay in Apple Watch. That means users who have one of the company’s wearables can hold it up to a compatible card reader to make a payment. It’s worth noting, however, that the feature is only available when users have an iPhone too. Android owners who are hoping to get the best of both worlds with Apple Watch will be out of luck.

10What if You Lose Your Device?

Both iOS and Android come with security features that will help customers who lose their mobile device. The owners of stolen iPhone or Android smartphones have the ability to remotely wipe their devices to prevent theft of their data or identities. Since fingerprint sensing plays a central role in Apple’s mobile payments, it makes it even harder for criminals to make fake purchases with a stolen phone. But it’s still possible, and so it’s nice to know both platforms have safeguards built-in.

11A Look at Broader Market Factors

Ultimately, the chances of either Apple Pay or Android Pay succeeding will come down to the broader market factors. Android Pay, for instance, will be running on far more devices than Apple Pay. Apple, however, has a head start and has done a fine job of signing deals with banks and credit card companies. But there are a number of competitors on the horizon. For now, the mobile payment business is wide open, and it’s unclear whether the winner will be the company offering its service on the most devices or delivering the most secure service.